Corporation Tax Software

|

|

|

|

|

|

|

|

|

|

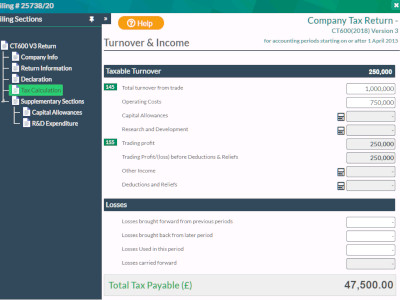

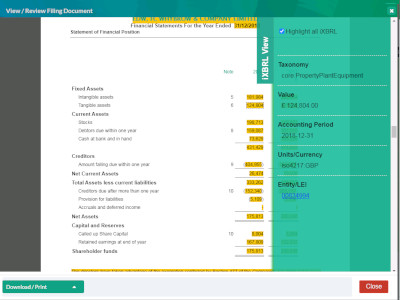

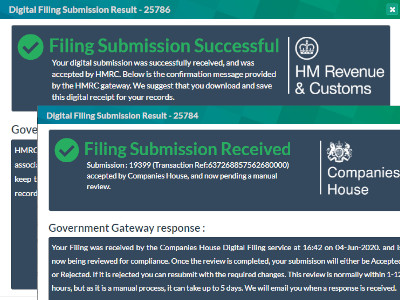

HMRC recognised Corporation Tax CT600 software designed for Small & Micro Limited Companies. Our online software enables the creation and filing of Company Corporation Tax to HMRC, with instant Corporation Tax calculation & computations and fully tagged IXBRL Company Final Accounts. Once ready, file online directly through to HMRC and Companies House.

Our simple-to-use forms guide you step by step to complete your CT600 Corporation Tax return. We additionally provide easy templates to create your fully IXBRL-compliant Company Accounts in the same easy-to-follow format. If you already have your IXBRL Accounts from another source, simply upload them, and we will submit them to HMRC with your CT600.

Like thousands of people who have successfully filed with us, we are confident you will find our software intuitive and simple. You only pay when you are ready to submit, so try for free before you commit.

Creates IXBRL Tagged

Company Accounts

Templates designed for both small and micro companies.

Create IXBRL Limited Company Accounts

Direct Submission to HMRC

& Companies House

All within the one platform, simple, quick, easy.

How to File a CT600 OnlineOur HMRC-recognised CT600 software has been designed specifically for small UK businesses, including small and micro limited companies. With our online software, you can easily create and file your HMRC corporation tax, complete with instant tax calculations and fully tagged IXBRL final accounts. Once you're ready, simply file directly online with HMRC and Companies House.

Our software provides simple-to-use forms that guide you through the process of completing your CT600 company tax return. We also offer easy-to-use templates that are fully IXBRL compliant, designed specifically for small and micro companies as required by HMRC. If you already have IXBRL accounts from another source, simply upload them, and we'll submit them along with your CT600.

Step by Step guide for how to make a Corporation CT600 Tax Filing.

How to create IXBRL Company Accounts

Templates designed for both small and micro companies.

Extended year Company tax filing

Where your accounting period is greater than 12 months.