You may have come across the term ‘Research and Development’ at some point in the workplace, but what does it actually mean? In general, research and development, more commonly known as R&D, refers the investments a company makes towards the innovation or improvement of a product, service, or process. Many companies invest in R&D in order to remain competitive in such tight markets.

You might now be wondering how this relates to filing your company’s tax return? Well, since R&D is such a great tool for innovation and enhancing the economy, the government wants to encourage this by offering tax relief for those who have invested in it.

Previously, there were two separate R&D tax relief schemes – one for smaller companies and one for larger companies, however, in 2023, HMRC released a statement saying that they would be updating their Research and Development schemes to introduce a new merged RDEC scheme, which would replace the current RDEC and SME R&D scheme by combining them into one. The new merged RDEC scheme comes into effect for accounting periods starting on or after the 1st April 2024.

What is an R&D claim?

As mentioned, a research and development claim is a type of tax credit scheme set up by the government which offers a tax reduction or pay-out to companies who have invested in projects related to researching and improving processes, products, or services within the science or technology field. Within the R&D tax credit scheme for smaller companies, you can claim enhanced expenses, meaning that you will get a portion of the money you spent on the research and development added as an extra expense for your company. The idea is that this then reduces your company’s taxable profits and either just reduces the corporation tax due for the period, or it either enhances its trading loss or makes the company loss making, thus offering a tax credit payable to the company instead. However, for larger companies, you typically would just be claiming a tax credit which would either be used to reduce the corporation tax due for the period, used against other company tax liabilities or would be received by the company as a tax credit pay-out, similar to the other R&D claim.

Before making the claim, no matter which one your company qualifies for, it is also important to check that the project you are claiming for meets the definition of R&D and is considered as a qualifying project. You can find out more information on this through our article ‘How To File a R&D (Research and Development) Tax Credit claim’ in our Easy Digital Filing knowledge base.

What is the difference between the SME R&D Claim and the RDEC Scheme?

Previously, the type of claim that you could make was dependent on the size of the company you were filing for. There was an SME R&D scheme, which was for smaller companies such as micro, small or medium entities, and there was also the RDEC scheme, which was just for larger companies. If you are filing for an accounting period up to the 31st March 2024, then you can still claim either one of these schemes. But you might be wondering – what’s the difference?

RDEC Scheme:

The RDEC scheme is a research and development tax credit scheme which is available to be claimed by large companies, or small and medium sized entities that are claiming for work that has been subcontracted to them, or that have received a notified State Aid for the project, or that are claiming for costs that have been subsidised in some way (such as a grant).

Within this scheme, you can claim additional relief for the allowable expenses that were related to the R&D project that was carried out – these are known as ‘qualifying R&D costs’. It’s important to double check whether the cost is qualifying before filing your claim – you can find the full list and guidance on which type of costs you can claim on through HMRC’s website.

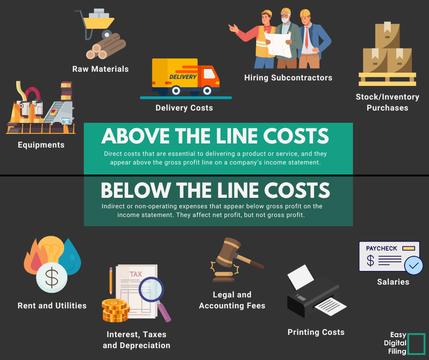

Once you have claimed for the costs, you will get a tax credit amount – no matter whether the company is profit making or loss making. This credit claim is an ‘above the line’ scheme, meaning that the tax credit is then added to your company’s profits, before tax. In this case, the corporation tax is charged on the actual tax credit claim as well. It may seem like this doesn’t benefit you to make the claim – but the catch is, after the corporation tax is calculated, the total tax due is then reduced by the amount of the claim as well. So, although it is added to your company’s profits, it does still help to reduce the corporation tax due.

The current rate for the RDEC scheme is 20%, and applies to all expenditure incurred from the 1st April 2023 onwards. Previously, for periods from the 1st April 2020 to the 31st March 2023, the RDEC rate was 13%.

SME R&D Scheme:

The other type of research and development claim you can make is the SME R&D claim, which is for micro, small and medium sized entities. This type of claim offers a higher return rate as it is designed specifically for smaller businesses.

The SME R&D claim is similar to the RDEC scheme in the sense that you still need to consider all qualifying R&D costs that were incurred in the period within your claim, however, this type of credit is a below the line scheme, rather than an above the line scheme – so the credit claim is not added to your profits. Instead, you get an enhanced expenditure which is added to your company's total taxable profits and either reduces the company's total corporation tax due, or they can get an actual tax pay-out (which is for companies who either were loss-making before the claim or become loss making after the enhanced expenditure was added).

For company’s whose accounting period started on or falls across 1st April 2023, the enhanced expenditure rate was 86%, meaning that you can claim an additional 86% of the qualifying costs (which are added to your total expenses), and also claim a 10% tax credit pay-out (if the company is loss making). Previously, the enhanced expenditure rate was 130% and the tax credit rate was 14.5%.

What is the Merged RDEC Scheme?

For accounting periods starting on or after the 1st April 2024, a new merged RDEC scheme will be replacing both the SME R&D Scheme and the old RDEC scheme. With this, they are merging the two schemes so that all qualifying companies can claim under one tax relief scheme instead. It is very similar to the current RDEC scheme in that it is considered as an ‘above the line’ scheme, and since the credit rate will stay at 20%.

However, there are some differences between the current RDEC scheme and this new merged scheme. To start with – it either uses the 25% main corporation tax rate or the 19% small profits tax rate, depending on whether the company was profit making or loss making before the credit claim is added to the company’s taxable profits. Previously, just the 25% main corporation tax rate was used, no matter the company’s status. It also takes into account the PAYE/NIC contributions at the same rate that it does in the SME R&D scheme when determining the tax credit claim - which is (PAYE/NIC contributions x 3) + £20,000. The introduction of this new scheme should allow for a more cohesive approach for all companies looking to make R&D claims.

Now, you may be thinking – how does this benefit me if my company’s purpose is to invest in research and development, since the relief is much lower? This is where the ‘ERIS’, or ‘Enhanced R&D Intensive Support’, scheme comes into place. This replaces the R&D intensive company claim, which was part of the SME R&D tax credit scheme. Within this, companies that were considered as ‘R&D intensive’, meaning that the company’s relevant R&D expenditure is at least 30% of its total expenditure for the period, were able to claim the same rates as within the standard SME R&D scheme, however, instead of claiming a 10% tax credit pay-out, companies were offered a 14.5% rate instead.

For more on filing for an R&D intensive company, please feel free to read our article ‘How to Claim R&D Relief for a R&D Intensive Company’ on our Easy Digital Filing Knowledge Base.

Also, keep an eye out for our article on the ERIS Scheme to find out more information on what this claim involves!